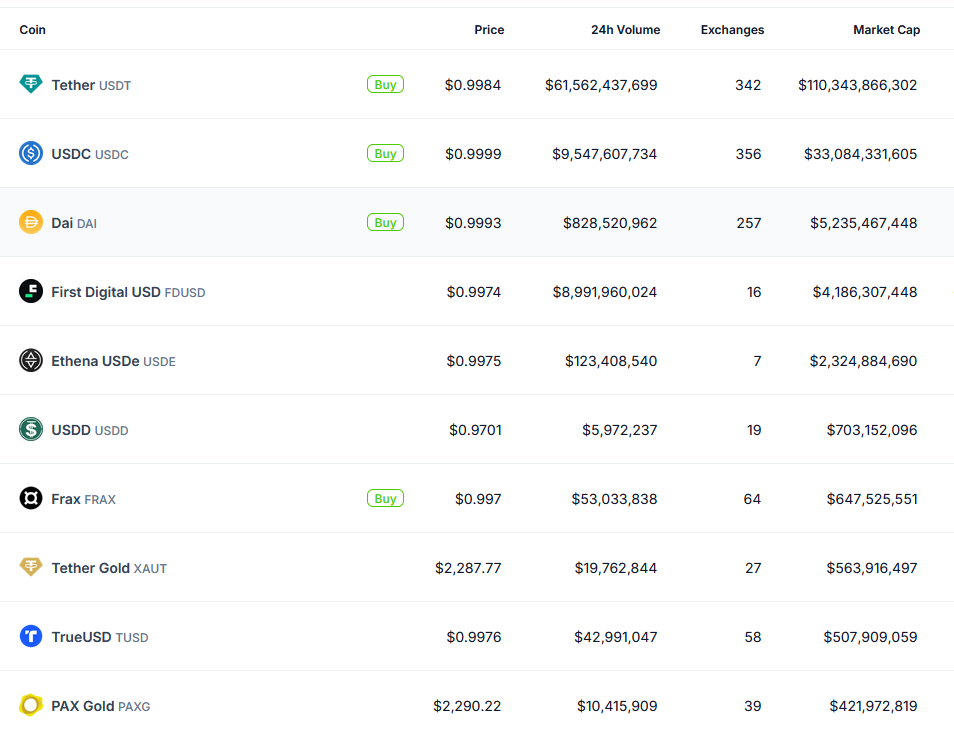

In recent times, gold-backed stablecoins have garnered significant attention. Amongst those tokens, Tether Gold and Paxos Gold stand out, with market capitalizations between $400 and $600 million, positioning them within the top ten global stablecoins.

Figure 1: Overview of current top 10 stablecoins (Source: Coingecko)

Adding to this development, HSBC, recognized as one of the world’s ten largest banks, has introduced the HSBC Gold Token. Read more about the HSBC Gold Token here. This novel stablecoin is physically backed by gold and is accessible to retail customers in Singapore through simple online banking methods or the bank’s app.

Why Tokenize Gold?

Tokenizing gold presents distinct advantages over traditional forms of gold investment, such as physical gold or digital gold certificates like Exchange-Traded Commodities (ETCs) or other financial market products.

Cost efficiency: Purchasing physical gold often involves a substantial spread, while digital gold incurs stock exchange fees. In contrast, HSBC’s tokenized gold only incurs minimal settlement fees, thanks to the utilization of a permissioned Distributed Ledger Technology (DLT).

Tradability: Unlike other gold products, tokenized gold can be traded 24/7, offering greater flexibility and liquidity to investors.

Outlook and Conclusion

Is tokenized gold the definitive future of gold investment? While it offers remarkable advantages for those looking to engage with gold’s price movements or seeking an easy way to trade gold, it is not a one-size-fits-all solution. Physical gold still holds value in traditional use cases such as secure self-storage and jewelry, which tokenized gold cannot replicate.

In conclusion, while tokenized gold is an exciting advancement in the world of precious metals, it complements rather than replaces the traditional roles of physical gold.