Authors: Jonas Gross, John Kiff

While much attention is focused on the retail central bank digital currency (rCBDC) ruminations of China, Europe and the United States, aside from China, smaller jurisdictions are actually leading the way. Although the People’s Bank of China launched their rCBDC pilot in April 2020, Banco Central del Uruguay completed its first pilot already in April 2018, the Central Bank of the Bahamas fully launched their Sand Dollar in October 2020, and the Eastern Caribbean Central Bank launched a pilot in March 2021. In this post, we take a deep dive into these leading rCBDC efforts.

Overview and overall retail CBDC landscape

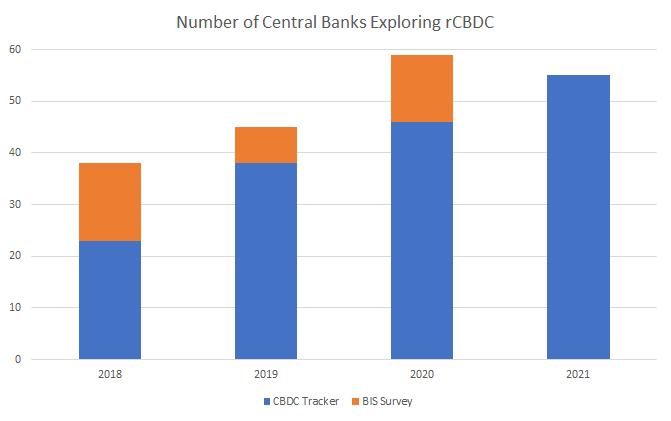

According to our CBDC Tracker there are currently at least 57 central banks exploring retail CBDC (rCBDC), of which 15 have either launched, piloted, or are in the very advanced exploration stages. We say “at least” because our count is based on reliable public sources (almost all from the central banks themselves). However, according to the Bank for International Settlements (BIS), 58 of the 65 central banks surveyed at end-2020 were exploring rCBDC. In any case, the growth in the number of rCBDC explorers has been remarkable (see figure below).

Before moving on to who’s doing what, it is important to be clear as to what is and is not rCBDC. The BIS defines rCBDC as a broadly available general purpose digital payment instrument, denominated in the jurisdiction’s unit of account, that is a direct liability of the jurisdiction’s monetary authority. There is also wholesale CBDC, which is limited to a set of predefined user groups, typically financial institutions. That’s not what we’re talking about here. Also the “direct liability of the monetary authority” condition precludes the Marshall Islands SOV and Cambodia’s Project Bakong.

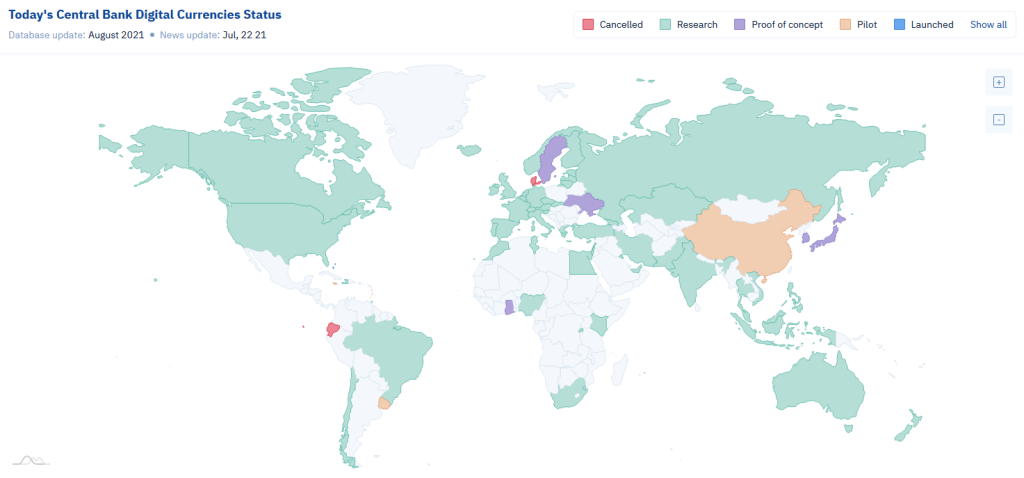

We categorize the status of the 57 central banks that we track based on their exploratory stages (see figure below). There are 5 jurisdictions that have either fully launched (Bahamas) or have launched pilots (China, Eastern Caribbean Central Bank, Jamaica, and Uruguay). Another 12 are in the advanced stages of rCBDC research, of which 5 have started (or soon will start) proofs of concept (Ghana, Japan, Korea, Sweden, and Ukraine). Proofs of concept (PoCs) differ from pilots as the former takes place in a laboratory environment (e.g., among central bank staff) and the latter involves “real world” testing, typically over limited time periods among limited populations.

The largest category comprises 40 central banks that are in the exploratory stage, typically consisting of desk research and perhaps some reaching out to technology platform providers. Some in this group may actually belong in the “advanced” group, but we have no direct evidence of that as we mainly analyze central bank communication.

Leading CBDC explorers

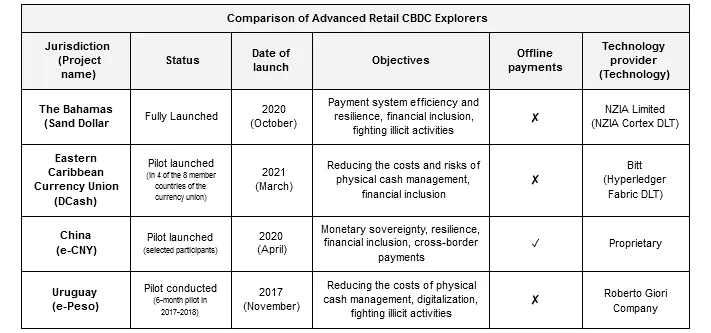

In the following, we talk about worldwide rCBDC explorers in more detail, focussing on the 5 rCBDC projects that have either fully launched or have launched pilots. In particular, we discuss the Bahamian Sand Dollar, the Eastern Caribbean DCash, the Chinese e-CNY, and the Uruguayan e-Peso in detail. Due to the lack of available open-source information, we don’t talk about the Jamaican CBDC project. We compare these projects and classify them according to the following criteria:

- Status: In which phase is the rCBDC project?

- Date of launch: When has the rCBDC system or the rCBDC pilot been launched?

- Objectives: Why does the central bank intend to issue a rCBDC?

- Offline payments: Are offline rCBDC payments without internet connection possible?

- Technology provider: Which company is the rCBDC technology provider? Is the rCBDC infrastructure based on a distributed or a centralized ledger?

We don’t talk about CBDC remuneration and distribution as both are similar for all projects. All projects considered follow a (cash-like) zero remuneration and are distributed via a two-tiered system from licensed payment services providers to end-users.

Sand Dollar: The only fully launched rCBDC in the world

Overview. The Bahamas is the first and only jurisdiction worldwide that has fully launched a rCBDC. It is available across the whole jurisdiction, i.e., all 700 islands, and, thus, for all 380,000 inhabitants. The Central Bank of the Bahamas (CBoB) launched the Sand Dollar in October 2020, after conducting several pilots in the islands of Exuma starting in December 2019 and Abaco starting in February 2020. The Sand Dollar is based on a distributed ledger technology (DLT) provided by the technology company NZIA Limited.

Objectives. The CBoB has issued the Sand Dollar as part of its payment system modernization initiative mainly to achieve the following four objectives: First, the efficiency of the existing Bahamian payment systems should be increased through more secure transactions and faster settlement speed. Today, the Bahamian economy is highly dependent on cash. This dependence raises high maintenance, distribution, and transaction costs but also increases dependence on ATMs to withdraw banknotes. However, in the Bahamas, this dependence is particularly problematic as the amount of bank breaches available declined sharply. Second, the Sand Dollar should improve financial inclusion as, according to the CBoB, there are severe gaps in the access to financial services. Thus, an easily accessible rCBDC might improve financial inclusion. Third, the rCBDC system should provide non-discriminatory access to payment systems without regard for age, immigration, or residency status. Fourth, the rCBDC should be used to fight money laundering, counterfeiting of money, and other illicit activities mainly stemming from the high market share of cash. Hence, the Sand Dollar utilizes different limits for users and companies (see below) to participate in the payment system.

Offline payments, access, and international use. Users can transact the Sand Dollar for free both digitally via smartphones (iOS and Android) and via a physical prepaid card. This prepaid card can be used for payments at every point-of-sale where Mastercard payments are accepted. Currently, it is not possible to conduct offline transactions as the money is not stored locally on the smartphone or the prepaid card, but has to be synchronized online. For receiving money, it is necessary to possess a central bank approved e-Wallet. In general, users with a bank account and a government-issued ID are allowed to transact B$10,000 of Sand Dollars monthly and hold B$5,000 worth. Non-residents and users that do not (or can’t) prove their identity and/or who do not want to (or can’t) link to a bank account, are faced with a transaction limit of B$1,500 per month and a balance limit of B$500 to limit potential illicit use. Business users have higher transaction and holding limits based on annual revenues. However, it is currently not possible to transact with the Sand Dollar outside the Bahamas.

Resources: Whitepaper and Homepage

DCash: First rCBDC pilot in a currency union

Overview. DCash, the rCBDC project in the Eastern Caribbean Currency Union (ECCU), is the first rCBDC pilot worldwide conducted in a currency union. The Union consists of the eight Carribean countries with approximately 1.4 million inhabitants, namely Anguilla, Antigua and Barbuda, Commonwealth of Dominica, Grenada, Montserrat, St Kitts and Nevis, Saint Lucia, and St Vincent and the Grenadines. The developing and testing phase of the pilot started in March 2019, rollout and implementation started in March 2021 in the member countries Antigua and Barbuda, Grenada, Saint Lucia and Saint Christopher (St Kitts), and Nevis. DCash is also based on a DLT developed by the technology provider Bitt.

Objectives. The Eastern Caribbean Central Bank seeks to achieve the following objectives with DCash. As for the Sand Dollar, payment efficiency should be increased. Today, cash is the mostly used means of payment in the ECCU leading to high economic costs. Furthermore, current digital payment methods and banking services are highly inefficient. Payment service providers usually charge a high transaction fee and require a relatively high minimum transaction amount. Also methods to settle cheque transactions remain slow and do not fully support the more and more digitized commerce. Further broad objectives include increasing opportunities for financial inclusion, growth, competitiveness, and resilience for citizens in the ECCU.

Offline payments, access, and international use. Offline DCash transactions are currently not possible. When initiating a payment, internet connection is required. If connection is lost, the payment will still be processed, but the adjusted balance will not be visible immediately but only as soon as connection is restored. International transactions both for non-residents in the ECCU and for non-residents abroad is, in contrast to the Bahamas, possible so that transactions work regardless of the physical location. Transactions can be conducted via a mobile App available for all iOS and Android users, conducted free of charge, and no minimum payment amount is required. Participating financial institutions and approved service providers manage access to the DCash system via converting bank deposits into rCBDC. Additionally, for users without a bank account, there are so-called value-based wallets that can be loaded at participating merchants and approved service providers that convert physical cash into DCash. While these wallets offer low know-your-customer (KYC) requirements and don’t require a bank account connection, they have low monthly transaction limits to limit potential illicit use (EC$1,000 to EC$2,700 depending on the user’s risk profile). There are also register-based wallets with higher limits that require a bank account linkage, varying from EC$3,000 to EC$10,000 per day.

Resources: Homepage

e-CNY: First CBDC pilot in an advanced economy

Overview. China was one of the first industrialized economies that started exploring rCBDCs back in 2014 and has already designed and developed their rCBDC system e-CNY. Since April 2020, this infrastructure is being tested excessively in terms of a large-scale pilot. In contrast to DCash, the pilot has not been revealed country-wide for the approximately 1.4 billion Chinese citizens but is open to selected entities in the whole country. The pilot is continuously being extended so that already households, banks, companies, merchants, etc. are testing the infrastructure. Possibly, e-CNY could be fully launched at the Winter Olympics in 2022. In contrast to the Sand Dollar and DCash, e-CYN is not based on a distributed ledger, but provides capabilities to build DLT applications on top of the centralized infrastructure. However, details about the technology used are not communicated by the People’s Bank of China (PBoC).

Objectives. Mu Changchun, Director-General of the Digital Currency Institute of the PBoC, said during the BIS Innovation Summit 2021 that the PBoC seeks to reach the following three objectives. First, financial inclusion should be increased by providing an easily accessible rCBDC. Second, the rCBDC system should increase payment system resilience, efficiency, and safety, and support “fair competition”. In China, mobile payments are used heavily, which makes Chinese dependent on digital private sector infrastructures. The PBoC wants to establish a public payment infrastructure that is independent of the private sector and also allows for transactions if, in times of emergency, such payment infrastructures are not available. Third, the PBoC wants to increase monetary sovereignty by manifesting its role and lower the use of non-fiat denominated money, such as cryptocurrencies, and foreign currencies. In the recent whitepaper on the e-CNY, it was further said that the e-CNY should explore the improvement of cross-border payments. Even if the e-CNY is currently mainly designed to be used for domestic payments, it should in the future allow for cross-border use.

Offline payments, access, and international use. The current e-CNY pilot also features offline payments as digital e-CNY tokens are stored on the phone and can also be transferred in an offline way from phone to phone. Today, it remains unclear in which form non-residents are allowed to use the e-CNY. As the PBoC stresses that the e-CNY might not be available for non-residents worldwide without limits, it seems reasonable to assume that e-CNY will be mainly available for residents, visitors, e.g. for the Winter Olympics, and tourists from China abroad. However, the exact design has not been revealed yet. Like those covered above, the e-CNY uses balance and turnover limits, depending on the registration process. Users who register only their SIM cards face very low limits (maximums of ¥2,000 per transaction and ¥5,000 per day, and maximum holdings of ¥10,000) versus those who undergo full know-your-customer requirements and link their bank accounts (¥50,000 per transaction, ¥100,000 per day, and ¥500,000 holding).

Resources: White Paper

e-Peso: First recent CBDC pilot

Overview. The Banco Central del Uruguay (BCU) ran the first rCBDC pilot in recent times. The first rCBDC was actually the Avant card system operated by the Bank of Finland from 1993 to 2006. Some might argue that the Banco Central del Ecuador Dinero Electrónico that operated between 2014 and 2018 was a rCBDC, but some others argue that it was merely a synthetic rCBDC, i.e., e-money fully backed by central bank money, because Ecuador is completely dollarized. In any case, in 2014 the BCU was approached by The Roberto Giori Company, a firm specialized in money security, with a preliminary rCBDC proposal, and after three years of planning and risk analysis, a six-month country-wide e-Peso pilot was launched in November 2017. The BCU considered it successful and technology worked without incidents. The BCU continues to analyze and study the possibility of rCBDC issuance.

Objectives. The BCU’s main motivation for exploring rCBDC issuance is to reduce the cost of managing physical cash. Also, rCBDC may facilitate financial digitalization by providing a platform for startups developing new products and services, and for incumbent financial institutions to offer better products and services. In addition, they are hopeful, based on empirical evidence, that the penetration of electronic means of payment will reduce crime rates. Finally, the CBU could plug into granular real-time payments data, which is not available with physical cash, to sharpen monetary policy analysis and efficiency.

Offline payments, access, and international use. Offline payment functionality was not tested during the pilot, and there has been no mention of offering it in future pilots, or ultimate launch. The e-Peso pilot was aimed at domestic usage only and no mention has been made of including that in the future. The e-Peso pilot did not apply the tiered user limits applied in the above projects. There were no daily transaction limits but individual wallet balances were limited to UYU30,000 and merchant wallets were limited to UYU200,000.

Resources: Pilot Recap and Peer Review

Authors

Jonas Gross is a project manager and research assistant at the Frankfurt School Blockchain Center (FSBC) and a PhD candidate at the University of Bayreuth, Germany. His fields of interests are primarily cryptocurrencies, stablecoins, and central bank digitail currencies (CBDC). Further, Jonas is co-host of the Podcast “Bitcoin, Fiat & Rock’n’Roll” and Chairman of the Digital Euro Association. You can contact him via mail, LinkedIn, and via Twitter (@Jonas_Gross).

John Kiff was a Senior Financial Sector Expert at the International Monetary Fund (IMF) from 2005 until he retired in April 2021. Prior to that, he worked at the Bank of Canada for 25 years. At the IMF he was part of the team that produces the semi-annual Global Financial Stability Report. More recently he has been focusing on over-the-counter derivatives, alternative risk transfer markets, and digital currency.